Which Type of Investor Are You?

Many investors are very focused on annual returns and others worry about losing money if the economy goes into a recession. The reality is that how to approach or react to different scenarios really depends on what type of investor you are. In other words, context and your financial plan are everything! The first investor […]

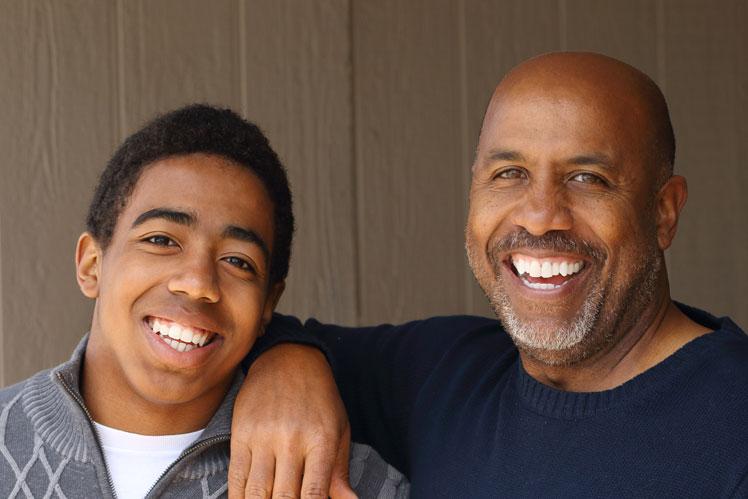

Teaching Children Financial Independence

Now may be the perfect time to teach your children about financial independence. There are plenty of real-life examples in the media of how not to manage your finances. To really teach children money management skills, they must learn to handle money personally and to make consequential decisions on how to manage it. An allowance […]

Gifts That Keep On Giving

It’s that time of year when wish lists for gifts are circulating. Before purchasing that iPad, game system, e-bike or leather jacket, consider a gift that will keep giving well into the future. After years of overspending on her children, this is what Maude will be doing this year. “I’d hate to add up what […]

Healthy, Wealthy and Wise

According to the Financial Consumer Agency of Canada1, good health is determined by mental, physical, and financial wellness. In other words: mind, body, and money. Physical and mental health makes sense, but what is financial wellness? Financial wellness doesn’t necessarily mean you have millions of dollars invested, although you’ve achieved an admirable goal if you […]

Financial Advice for New and Expecting Parents

Whether you’re expecting a child, planning to have one soon or have just become a new parent, you’re about to embark on one of the most rewarding journeys that life has to offer. It’s also one of the most expensive: an average of $12,500 per year until age 18.1. That’s $225,000 per child, and it […]

Optimizing Your RRIF

Registered Retirement Income Funds (RRIFs) are one method of drawing an income from Registered Retirement Savings Plans (RRSPs) in retirement. There are a few things to consider to get the best value from your retirement savings with RRIFs. For many Canadians, RRSP savings will be the major source of their retirement income. The main concern […]

Revisiting Your Financial Plan

The hits keep coming! With the recently concluded Federal election essentially changing nothing in Ottawa, there is little doubt that annual spending deficits will probably continue to reach new levels. Along with this renewed deficit spending Canadians can expect to see higher consumer prices as various economic disruptions continue to impact Canada and other nations […]

Moving Your Employer Pension Between Jobs

As the pandemic slowly recedes, work-life balance trends emerge. A recent Angus Reid survey revealed that 19% of Canadians would quit or look for a new job if required to return to the office. 25% of survey participants stated they would look for new employment after returning to office. If you have a pension at […]

Using a Trust to Avoid Probate Fees

When Simon’s father passed away two years ago, he didn’t think much about how his estate would be handled. His mother had died five years before, and his dad’s will was clear about how his assets would be divided. Then came probate, a process to confirm the validity of his will. Not only did unexpected […]

A Point In Time

There are moments in time when significant economic shifts occur that alter the future. One such moment occurred in late August 2019 at the close of the Jackson Hole Economic Symposium. This is an annual and exclusive central banking conference to foster open discussion about important and current policy matters. Bank of England Governor, and […]